ESG Data and ESG Scores: 10 free sources you can use to start your ESG analysis

This Insights article will provide you with a general overview about ESG data and ESG scores (sustainability data). In the introduction, it will establish a short definition and highlight the importance of ESG data for the analysis of a company. In the next chapter, we will show you 10 free sources for ESG data which can complement your financial analysis. All information can be accessed without registration or special subscription. The following chapters will focus on selected data topics such as standards for the collection and methodologies for analyzing data.

An Introduction to ESG Data and Scores

Definition of ESG Data

ESG stands for Environmental, Social, and Governance. ESG data refers to information related to a company’s performance in these three areas. Generally, these three factors are considered important indicators of a company’s overall sustainability and long-term financial performance. Environmental data encompasses a company’s impact on the environment, such as its carbon emissions, energy use, and waste management practices. Social data evaluates a company’s relationships with its employees, customers, and the communities it operates in, e.g., factors such as workplace diversity and human rights practices. Governance data looks at a company’s management practices and policies, including its transparency, accountability, and alignment with stakeholder interests.

ESG data plays an important role for investors while seeking to understand the potential risks and opportunities associated with their investments. By incorporating ESG data into their investment analysis, investors can better understand the potential impact of ESG factors on the future growth of the company. Stakeholders such as governments, tax authorities and NGOs are also paying increasing attention to ESG data and pushing towards more disclosures. But also, companies themselves start recognizing that their ESG performance can impact their reputation, regulatory compliance, and overall financial performance.

Importance of ESG Data in Investment Decisions Making

This paragraph outlines why ESG data plays such an important role. The list provides an indicative view and many more topics can be added.

Long-term Financial Performance

ESG data provides valuable insights into a company’s long-term financial performance and its potential for future growth. Companies with strong ESG practices are typically more sustainable, have lower operating costs, and are better equipped to navigate challenges and disruptions.

Improving Corporate Behavior

By incorporating ESG data into investment decisions, investors can also play a role in shaping corporate behavior. Companies are increasingly recognizing the importance of ESG performance in attracting investment and are taking steps to improve their ESG practices.

Risk Management

ESG data can also help investors identify and manage potential risks associated with their investments. For example, companies with poor environmental practices may face increasing regulatory scrutiny or public backlash, which could impact their financial performance.

Increased demand for sustainable investing

The demand for sustainable investing has increased in recent years, driven by rising awareness of the importance of ESG data and the positive impact it can have on financial performance. This trend is expected to continue in the future.

Meeting regulatory requirements

In some regions, regulators are mandating the consideration of ESG data in investment decisions. Investors must stay informed about these requirements and take them into account when making investment decisions.

Alignment with personal values

ESG data allows investors to align their investments with their personal values and beliefs, such as environmental sustainability or social responsibility.

10 Free ESG Data Sources and Scores

Accessing ESG data can be expensive and most of the time a license with a data provider is required. Nevertheless, certain data providers and organizations open up their scores and ratings to a broader audience for free. As a consequence, retail investors are able to do their own research and assess companies they would like to invest in. We put together a list of the top 10 free data resources for you.

1. WWF Risk Filter Suite - Biodiversity and Water Risk Data

WWF offers a data set for biodiversity and water physical risks. The tool comes with multiple interactive screens and filter functionalities. The “Explore” functionality allows you to browse a map which indicates physical risk areas on a scale from very low to very high. You can access the WWF Risk Filter Suite here.

2. MSCI - ESG Fund Ratings and Climate Search Tool

The MSCI ESG Fund Ratings and Climate Search Tool is suitable for an analysis of Funds and Exchange Traded Funds (ETFs). By entering a fund name, ticker or ISIN, you can explore five different areas. The information provided include how well the fund is aligned to global climate goals, its exposure to climate risk and opportunities and many more. You can access the MSCI ESG Fund Ratings and Climate Search Tool here.

3. MSCI - ESG Ratings & Cliamte Search Tool

Similar to be data set for funds and ETFs mentioned above, MSCI offers ESG ratings for single companies as well. By entering a name or ticker, you will get information about commitments to reduce carbon emissions, alignment to net zero methodologies, ESG scores, controversial business activities and many more. Click here to access MSCI´s ESG Ratings & Climate Search Tool for single companies.

4. Sustainalytics - Company ESG Risk Ratings

Sustainalytics provides an extensive data set for ESG Risk Ratings on their website. You can either search by entering a company or ticker, or you can scroll down the list by using filters such as industry or rating. Overall, Sustainalytics makes ratings for more than 13.200 companies available. Please click here to access the ESG Risk Ratings of Sustainalytics.

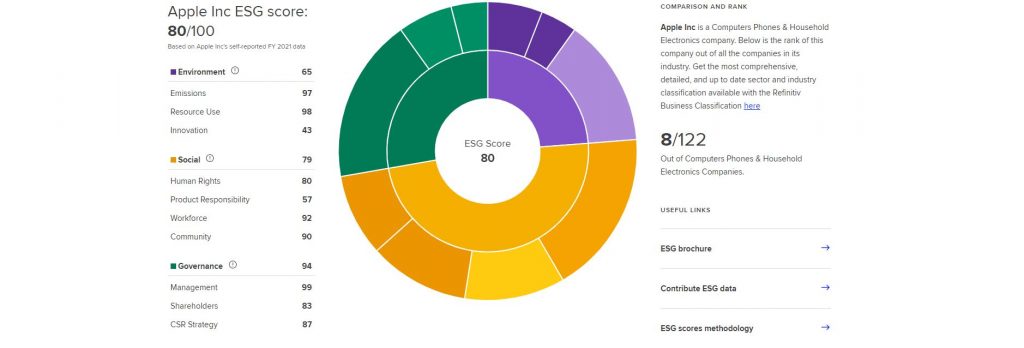

5. Refinitiv - ESG Company Scores

Refinitiv offers Company ESG Scores on their website as well. By searching for a specific company, you can retrieve an overall ESG score and explore a break-down into environmental, social and governance scores. Refinitiv also shows you the rank of the company you were searching for compared to their industry peers. Click here to access the Company ESG Scores of Refinitiv.

6. SASB - Materiality Finder

SASB is one of the most important frameworks in regards to sustainablity risk and materiality. On the website, you can explore relevant issue categories within an industry. On top, you can enter any company and the most relevant ESG issues will be displayed. Click here to access the Materiality Finder of SASB.

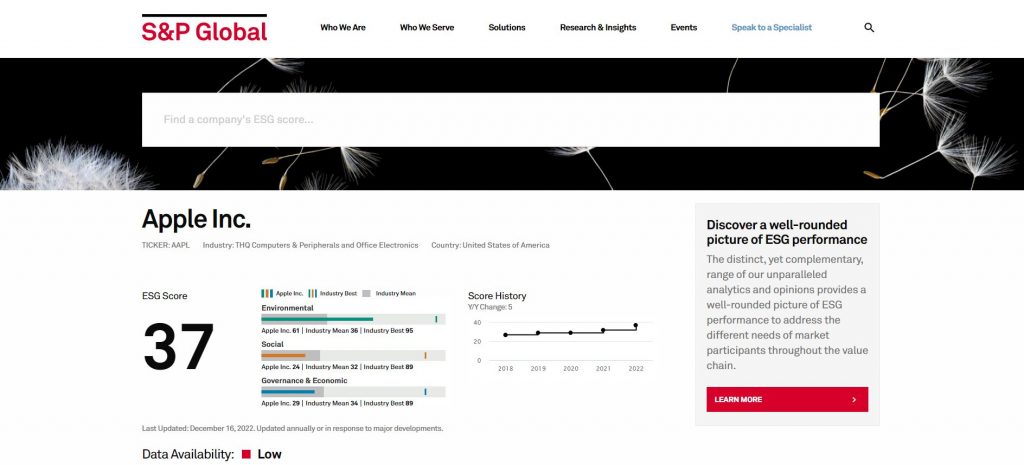

7. S&P Global - ESG Scores

S&P Global Sustainable1 is another big data provider which allows you to discover the ESG scores of many companies. The scores are drilled down into environmental, social and governance criteria for up to 30 focus areas across sub-industries. Beside the ESG scores, you get more insights into the data contribution based on public disclosures. Click here to discover the ESG Scores of S&P Global.

8. UN Data - Country specific data

UN Data connects 32 databases and 60 million records within one search functionality. The website let you explore economic, environmental and social indicators for all countries of the world. It is a great source of information in a country- or region-specific context. It can also serve as a starting point if you analyze potential sovereign bond investment opportunities. Click here to open the UN Data website.

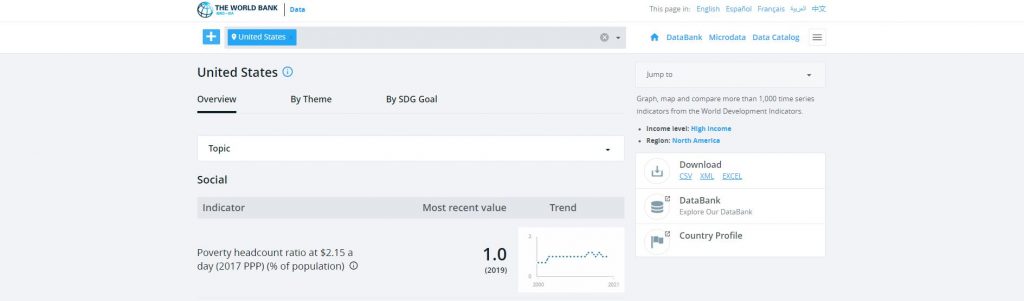

9. World Bank Open Data

Similar to the UN Data website, World Bank Open Data offers a huge data set on a country level. You can either search by country or indicator. It is a great source of knowledge for starting your own research. Click here to open the World Bank Open Data website.

10. Sustainable Development Report

The Sustainable Development Report website allows you to explore the Sustainable Development Goals for different countries. Furthermore, you can compare different countries to eachother and explore historic trends. Click here to access the the SDG country profiles of Sustainable Development Report.

Standards for Collecting ESG Data

Overview of ESG Rating and Ranking Systems

ESG data is collected from various sources, including companies, government agencies, and non-profit organizations. To ensure that data is consistent and comparable, a number of rating and ranking systems have been developed. These systems provide a standardized way of evaluating a company’s ESG performance, making it easier for investors to compare the ESG performance of different companies.

ESG rating and ranking systems can be broadly divided into two categories: third-party ratings and in-house ratings. Third-party ratings are provided by independent organizations, such as Moody’s, S&P Global, and MSCI, and are widely used by investors as a reference for ESG analysis. In-house ratings, on the other hand, are produced by companies themselves and provide a self-assessment of their ESG performance.

The criteria used in ESG rating and ranking systems vary depending on the organization and the focus of the rating. Some common criteria include a company’s environmental impact, employee treatment, governance practices, and social impact. The data used to evaluate these criteria is obtained through a combination of self-reported information, public sources, and expert analysis. ESG rating and ranking systems have several advantages, including providing a standardized way of evaluating a company’s ESG performance, making it easier for investors to compare the ESG performance of different companies and providing a reference for ESG analysis.

However, it’s important to note that ESG rating and ranking systems are not without their limitations. These systems can be subject to biases, such as a focus on certain ESG factors over others, and the data used to produce the ratings can be incomplete or unreliable. As a result, investors should use ESG ratings and rankings as one of several sources of information when evaluating a company’s ESG performance.

Criteria for Evaluating ESG Data Providers

When evaluating sustainability data providers, it’s important to consider a number of criteria to ensure that the data being used is accurate, relevant, and up-to-date. Some of the most important criteria for evaluating ESG data providers include:

The quality of the data being provided is critical, as it will directly impact the accuracy of the ESG analysis. This includes factors such as the completeness and reliability of the data, as well as the accuracy and consistency of the data over time.

The methodology used by the ESG data provider to collect and analyze the data is also important. This includes the sources of the data, the methods used to verify the data, and the approach used to analyze and present the data.

The coverage of ESG factors and issues by the data provider is also critical. This includes the number of companies being covered, the ESG factors being evaluated, and the level of detail provided for each factor.

ESG data should be up-to-date, reflecting the latest information available. This is important because ESG performance can change rapidly, and outdated data may not accurately reflect a company’s current ESG performance.

The cost of the data is also an important consideration, especially for investors with limited budgets. In general, third-party ESG data providers can be more expensive than in-house data, but they may also provide a higher level of quality and reliability.

Importance of Consistency and Comparability of ESG Data

Consistency and comparability of ESG data are crucial for making informed investment decisions and for driving the growth and development of the ESG market. Consistent and comparable ESG data enables investors to accurately compare the ESG performance of different companies, which is essential for making informed investment decisions.

Consistent ESG data is data that is collected and analyzed using standardized methods and criteria. This ensures that the data is comparable across different companies and sectors, making it easier for investors to compare the ESG performance of different companies. Comparable ESG data, on the other hand, is data that can be directly compared across different companies and sectors. This is achieved by using standardized ESG rating and ranking systems, which provide a consistent framework for evaluating a company’s ESG performance.

The importance of consistency and comparability of ESG data cannot be overstated. Without consistent and comparable ESG data, it would be difficult for investors to accurately compare the ESG performance of different companies, making it difficult to make informed investment decisions. Additionally, the growth and development of the ESG market would be hindered, as there would be no standardized way of evaluating a company’s ESG performance.

To ensure consistency and comparability of ESG data, investors should use ESG data providers that have a proven track record of providing high-quality, consistent, and comparable ESG data. They should also use a range of ESG data sources, including third-party ratings and rankings, company reports, and expert analysis, to build a comprehensive understanding of a company’s ESG performance.

In conclusion, consistency and comparability of ESG data are crucial for making informed investment decisions and for driving the growth and development of the ESG market. By using high-quality, consistent, and comparable ESG data, investors can ensure that they are making informed investment decisions that support the overall growth and development of the ESG market.

Methodologies for Analyzing ESG Data

Quantitative Analysis of ESG Data

Quantitative analysis is one of the most commonly used methodologies for analyzing ESG data. This approach uses numerical data, such as financial data and performance metrics, to evaluate a company’s ESG performance.

In a quantitative analysis of ESG data, the data is analyzed using a set of standardized metrics and indicators that are designed to measure specific aspects of a company’s ESG performance. For example, a quantitative analysis might include metrics such as carbon emissions, water usage, or employee satisfaction, as well as indicators such as energy efficiency or workplace safety.

One of the key benefits of quantitative analysis is that it provides a clear and objective picture of a company’s ESG performance, making it easier to compare the ESG performance of different companies. Additionally, quantitative analysis can be automated, making it easier to analyze large amounts of data in a timely and efficient manner. Whenever limited numerical or not reliable data is available, the quantitative analysis might fail.

Additionally, some ESG factors, such as human rights or environmental stewardship, are difficult to quantify and may not be accurately captured by numerical data. In these cases, qualitative analysis, which uses non-numerical data such as stakeholder opinions or expert analysis, may be more appropriate.

In conclusion, quantitative analysis is an important methodology for analyzing ESG data, as it provides a clear and objective picture of a company’s ESG performance. However, it’s important to be mindful of its limitations, and to supplement quantitative analysis with other methodologies, such as qualitative analysis, to gain a comprehensive understanding of a company’s ESG performance.

Qualitative Analysis of ESG Data

Qualitative analysis is another common methodology for analyzing ESG data. This approach uses non-numerical data, such as stakeholder opinions or expert analysis, to evaluate a company’s ESG performance.

In a qualitative analysis of ESG data, the data is analyzed using a set of qualitative criteria, such as governance structures, human rights policies, or sustainability practices, to assess a company’s ESG performance. For example, a qualitative analysis might include an evaluation of a company’s governance structures to determine the level of transparency and accountability, or an analysis of the company’s human rights policies to determine their commitment to responsible business practices.

One of the key benefits of qualitative analysis is that it provides a deeper understanding of a company’s ESG performance, as it takes into account factors that may not be accurately captured by numerical data. Additionally, qualitative analysis allows for a more nuanced understanding of a company’s ESG performance, as it considers factors such as stakeholder opinions, expert analysis, and cultural differences.

In conclusion, qualitative analysis is an important methodology for analyzing ESG data, as it provides a deeper understanding of a company’s ESG performance. Furthermore, it takes into account factors that may not be accurately captured by numerical data.

Summary and Conclusion

Do you always need to pay for ESG data and score? No, the Insights article provided 10 totally free website which allows you to start with your own ESG analysis. Many data providers such as MSCI, Sustainalytics, Refinitiv or S&P Global provide access to ESG scores through their website. Although you might not be able to explore each score on the highest granularity level possible, it is a great tool to establish an understanding about a company´s ESG performance. Furthermore, you can start comparing companies across sectors and learn more about specific ESG risks and opportunities.